WHY SCZONE

Overview

- Existing ecosystem and access to markets supported with accessibility to 6 SEAPORTS & 2 AIRPORTS.

- Strong cost competitiveness for manufacturing.

- Attractive financial incentives.

- Robust regulatory support for investors.

- World-class service levels.

- Providing infrastructure within the entire SCZONE land.

A Unique LocationAT THE HEART OF THE GLOBAL TRADE ROUTE

Located around the main international maritime route “Suez Canal passageway”, which connects Europe, East and North Africa via the Suez Canal with Asia passing through Arabian Gulf serving the majority of global trade, where:

- 20% of the international container trade

- 10% of seaborne trade

- 18,000 ships passing through each year.

SCZONE aims to be one of the main logistics hubs in the region, supported by a number of mega infrastructure projects, especially logistics projects, such as doubling the pathways of the Suez Canal to minimize passing time, cost of operation and attract more vessels and cargos.

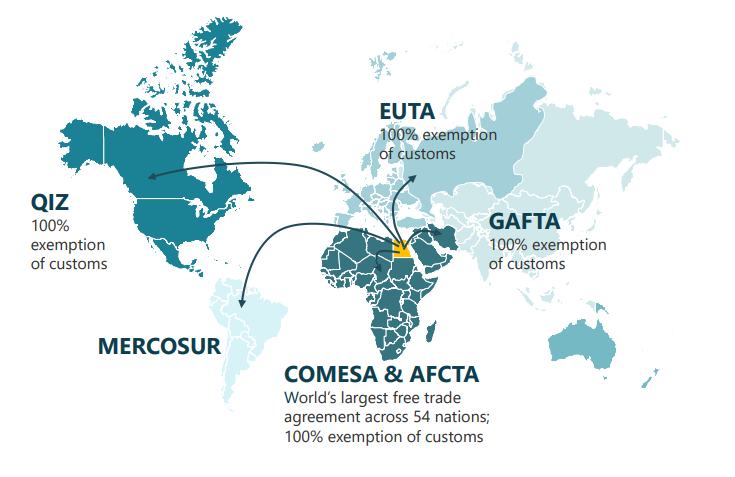

Trade Agreements

Egypt and the European Union (15 countries) signed on June 25, 2001 in Brussels an agreement to establish a free trade zone between the two parties within a maximum period of 12 years from the entry into force of the agreement (gradual liberalization), while the liberalization of Egyptian imports of industrial goods that are of European origin extends to 16 years.

In 2010, Egypt signed a preferential free trade agreement with the Southern Common Market (Mercosur), which provides preferential concessions for Egyptian exports to enter the Latin American markets and reduces the cost of Egyptian imports from some Latin American countries such as sugar, meat and soy oil.

The free trade agreement aims at reducing custom duties by more than 90% between Egypt and the MERCOSUR countries and completely abolish custom duties on agricultural commodities, in addition to finding solutions to regulate “rules of origin” matters, providing preferential treatment guarantees and enhancing cooperation in the fields of investment, services, and others.

The African Continental Free Trade Agreement (AFCFTA) is a trade agreement between 49 member states of the African Union. it aims at creating a single market followed by freedom of movement and a single currency. The Africa Free Trade Agreement was signed in Kigali, Rwanda on March 21, 2018. The agreement will enter into force soon, and the African Continental Free Trade Area will come into effect. The agreement will function as an umbrella to which protocols and annexes will be added.

Egyptian exports of industrial goods to the EFTA countries (Iceland, Liechtenstein, Norway and Switzerland) are exempted from all customs, duties and taxes.

The Agadir Agreement was signed between Egypt, Morocco, Tunisia and Jordan, concerning commodities exchanged between the member states.

Egypt has signed the Common Market Agreement for Eastern and Southern Africa (COMESA), which exempts products from all customs duties, fees and other taxes. The population of the countries that signed the agreement amounts to 583 million people, and thus it represents a wide and open market for many Egyptian products.

Signatories: Egypt, the United States of America and Israel. The agreement aims at opening markets without specifying quotas or imposing customs duties in front of the products manufactured in “Qualified Industrial Zones. Egypt is one of the industrialized countries, and the Suez Canal Economic Zone can benefit from the available connections with the multinational and local institutions for the development of the industrial sector.

Seventeen (17) members of the Arab League signed the Arab Free Trade Agreement in 1981 and agreed on its terms in 1997 with the aim of facilitating and developing trade between Arab countries.

Financial Incentives

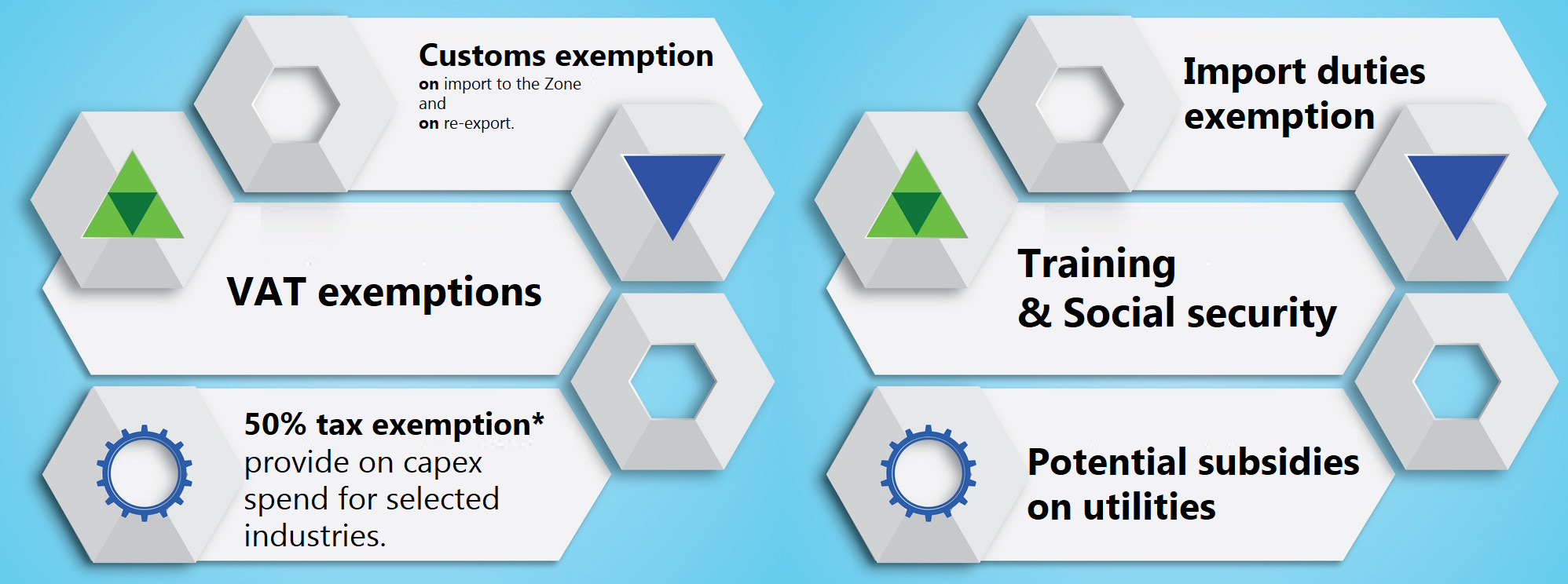

Competitive Exemptions

F E A U T R E S

Connectivity Domestically and Continentally

The Egyptian government has established a huge network of roads estimated 9000 KM of roads connecting Delta, upper Egypt and Sinai Peninsula with the economic zone.

The new road network extends regionally to Africa

- North to South (Cairo – Cape town)

- West to East (Dakar – Nairobi)

It integrates regional projects in the neighboring countries and raise transport efficiency and responds to safety measures.

- Egypt’s Free Trade Agreements ensure rapid access to 2 Billion consumers Complemented by world class ports.

- High quality logistics services, African Highways and Preferential Trade Agreements, such trade agreements allow investors to efficiently, and competitively, access regional and global markets in Europe, Africa, Middle East and Asia.

- Access to a promising domestic market; Egypt has a large and growing domestic market of some 100 million people of whom 65% are of working age. With rising standards of living, the purchasing power of the domestic market will drive growth in many sectors.

Autonomous legal framework:

- SCZone’s Board of Directors is empowered by the law to instate streamlined procedures, and to grant more incentives for the promising projects.

- Decision in a single place to support and facilitate a fast business start-up, and operation in the Zone.

Competitive operation cost:

- SCZone is clearly in a standalone position in terms of utilities shared, manpower, and training costs.

- Competitive wages of low and high skilled labor.

- Facilitated payments of the usufruct fees.

In accordance to the newly issued Investment Law 72/ 2017, and the Law of Special Economic Zones No. 83/2002 and its amendments by the virtue of law No. 27/2015, SCZone is entitled to grant investors a competitive incentive package as follows:

Financial Incentives

Customs:

(Tax exemptions for all imports required to carry out the activity/business

Customs are due on the foreign components imported only when the final product is exported to the local market Egypt.

VAT (Value Added Tax):

- 0 % VAT; on all imports including imported commodity from the Domestic market to the Zone.

- 14% VAT; only applicable on products exported to the local market.

Income Tax:

- Investment projects in the zone are eligible to a deduction from the net taxable profits equivalent to 50% of the total investment costs. The deduction shall not exceed 80% of the paid capital and for a period of time that does not exceed 7 years from the date of operation.

- Investors at SCZone are eligible to the benefits of the Free Trade Agreements Egypt is signatory of, including (GAFTA, COMESA, Agadir, European Partnership Agreement, MERCOSUR, FTAA, African Free Trade Agreement)

“SCZone offers a unique value proposition for investors to maximize earnings”

Skilled Labor

- The availability of skilled labor in many industrial sectors at competitive costs compared to other regions.

- The Authority may bear part of the technical training cost for Egyptian workers as a financial incentive for company either during the initial phase of the project or after establishment.

Foreign labor conditions:

- According to the law no. 83/2002, SCZone has the capacity to, and upon the approval of SCZone’s Board of Directors, increase the proportion of foreign workers to meet different projects’ needs.